Knowing what your competition is up to and comparing their findability to your own gives marketing and SEO departments plenty of ammunition to come out ahead. In practice, getting the right information and using competitive data to achieve goals can be difficult and time consuming. With the right tools, and a few best practices, marketers and SEO departments can create a manageable workflow to track competitors, discover new or niche competitors as they enter your space, and improve your own findability against them.

Keeping Tabs on the Competition

There are many reasons to keep tabs on the competition. Most commonly, competitor data is used to establish brand positioning in terms of products and features. But that doesn’t tell the whole story. You’ll want to include audience perception data as part of your brand positioning. Knowing how you and your competition are perceived by your target audiences is critical to understanding where you may have the competitive advantage and where your competition is winning audience good will. When it comes to audience perception, everyone’s opinion matters. Talk to customers, employees, thought leaders, innovators, analysts, and anyone willing to share their opinion and perception of your brand.

Another reason to watch competitors is to keep track of competitive messaging. You’ll want to know how other brands are talking about the same topics you’re talking about and what competitive content may be taking traffic away from you. Hopefully you’ll discover some content holes that you can fill with your authentic content.

Another reason to watch competitors is to keep track of competitive messaging. You’ll want to know how other brands are talking about the same topics you’re talking about and what competitive content may be taking traffic away from you. Hopefully you’ll discover some content holes that you can fill with your authentic content.

“Before you create new content, it’s important to know what content your competitors have distriubted that might be similar and already getting traction,” advises Erin. “Using that knowledge, you can avoid creating duplicate content and spend your time generating original content that will be better received.”

Changes in competitor messaging or competitor positioning can signal market opportunities, or market shifts. Watching the competition for changes in audience response or rises and falls in keyword ranking can serve as an early alert for a new market need or harken the dying of an existing market trend. While you don’t want to base all your product and marketing strategy on what the competition is doing, combining your own data with that of your competitors will give you a more complete picture of market shifts than the view you get with just your own products and sales data.

Competitor Rank and Findability

There are lots of places to get various kinds of data about competitors. You can spend a lot of time gathering data about competitors and end up with a lot of disparate data. If you’re going to be looking at competitor data and using the information to inform your strategic decisions, make sure you’re focusing on the right metrics.

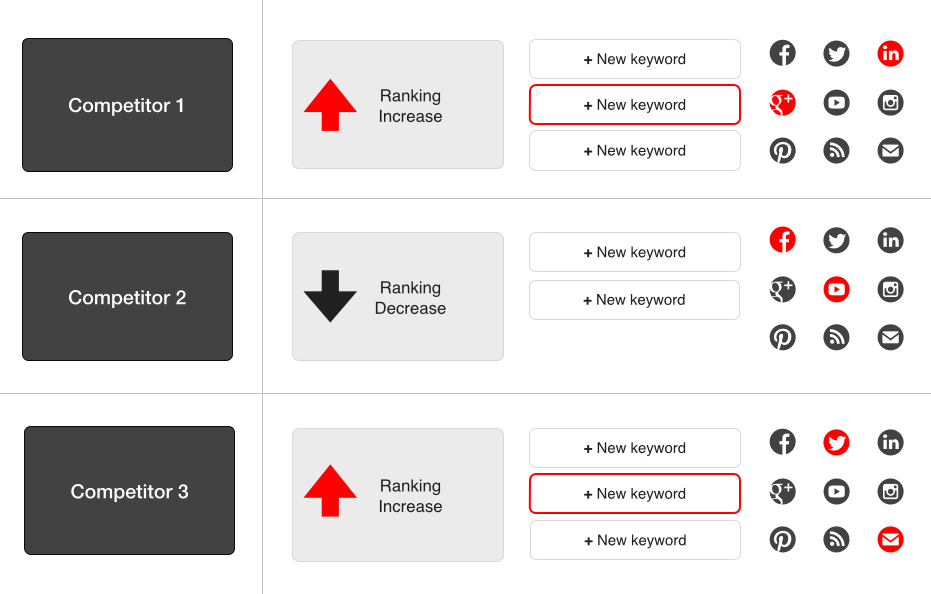

As marketers, we need to be focusing on something SEO departments have had their eyes on for awhile, competitor rank. While knowing overall competitor ranking is important, we need to be paying attention to competitor rank on search engines and devices for findability of their content.

As marketers, we need to be focusing on something SEO departments have had their eyes on for awhile, competitor rank. While knowing overall competitor ranking is important, we need to be paying attention to competitor rank on search engines and devices for findability of their content.

“Content findability is an indication of the organic reach of a competitor,” states Erin. “It looks beyond what a brand is paying for to drive traffic. Anybody can pay for ads, pay for time, and drive traffic. What you want to know is the average rank for organic findabilty based on search terms, keywords, etc…”

Track competitor ranking based on keyword and content groups. Groups may include:

- Feature groups

- Product groups

- Geography groups

- Campaign message groups

Social media metrics are important for competitor intelligence, if you’re measuring the right data. Of course, simply comparing yourself to your competitor based on how many followers and how many likes is probably not the best indicator of real social media influence. Simply seeing a growing number of followers does not indicate that the competition is connecting with a relevant audience that will eventually become prospects, customers, or evangelists.Tracking social engagement and ranking on content will give you a powerful measure of how you and your competitors are percieved and how successfully you are each interacting with your audiences.

“I think what we’re looking at is real engagement with actual people, actual potential users that have a real impact,” states Erin. “I don’t think that having the most followers or the most likes or fans or shares is always indicative of who the best brand it. Sometimes it’s just noise.”

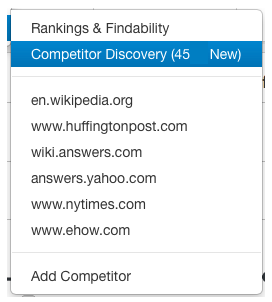

Competitor Discovery

Competitor analysis is not a one and done proposition. Once you start monitoring a list of competitors, it’s important to be constantly on the look out for new competitors, and those niche competitors who may be entering your space. Very rarely are other companies exact one-to-one competition with your product and services. This means there a lot of oppotunities for new competitors to arise who touch on some part of your product offering. While you don’t need to change your product roadmap in response to every new competitor, you may become aware of new problems or market needs that someone else is coming in to fill. Watching how those new products and messages are received by the market will give you insight into where the market may be going, or areas where your product could be improved to fill a growing need.

Competitor analysis is not a one and done proposition. Once you start monitoring a list of competitors, it’s important to be constantly on the look out for new competitors, and those niche competitors who may be entering your space. Very rarely are other companies exact one-to-one competition with your product and services. This means there a lot of oppotunities for new competitors to arise who touch on some part of your product offering. While you don’t need to change your product roadmap in response to every new competitor, you may become aware of new problems or market needs that someone else is coming in to fill. Watching how those new products and messages are received by the market will give you insight into where the market may be going, or areas where your product could be improved to fill a growing need.

If you don’t keep an eye on your competitive landscape, you may be surprised to find that a brand that was once a competitor, has now taken a slightly different path, and is no longer a viable competitor in your market. You might discover a brand that was too far on the periphery to worry about has started to overlap more into your product offering and is becoming a strong competitor in your space. These changes happen quickly and require more than just a peripheral glance once or twice a year.

“These summer doldrums months are a good time to go back and do some more competitor analysis,” notes Erin. “At Ginza, we have a competitor discovery tool that identifies competitors based on the content and keyword groups that are important to you. We also show you a list of all the exact keywords and the specific content that your competitors are creating that’s competing with you.”

Competitor Insights that Inform Decisions

It doesn’t do much good to gather a bunch of data, create a neat looking report, and then continue doing what you were doing before. Taking the time to get the right data, means getting actionable insights that are then used to improve marketing and SEO efforts. The goal, afterall, is to improve findability. Keeping a finger on the pulse of the market means looking at some form of competitor insights on a daily, or at least weekly, basis.

While keeping an eye on things like average rank and findability, also keep an eye on changes. Watch for spikes and falls that coincide with your campaigns, products, features, content, and any other segments created for keyword or content groups. On a weekly or monthly basis check out top keyword activity to keep tabs on what content is already in your space to avoid spending your time creating duplicate, competing content.

“The top keyword activity metrics are very important and can be found on the GinzaMetrics dashboard, ” states Erin. “For all the keywords and topics you’re tracking for your content, we’re tracking for your competitors, too. What you’ll see is the biggest competitor gains for the specific content that may be competing with your campaign topics.”

“The top keyword activity metrics are very important and can be found on the GinzaMetrics dashboard, ” states Erin. “For all the keywords and topics you’re tracking for your content, we’re tracking for your competitors, too. What you’ll see is the biggest competitor gains for the specific content that may be competing with your campaign topics.”

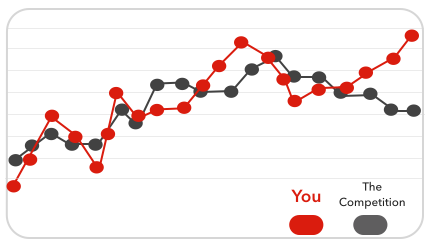

The actionable data you collect about your competitors should be the same data you share with your executive team. Use your data and reports to create benchmarks to understand the normal ebb and flow of your business and your markets. Those benchmarks come in handy later when you want to show the success of a specific campaign or to make recommendations to your team or executive suite.

To get started, you’ll need to put a stake in the ground at some point in time and then highlight benchmarks and norms at regular intervals. Instead of looking at competitor data from a metric-to-metric standpoint, measure your performance and theirs based on keyword and content groups over time. Once you’ve collected data over a pre-determined period of time, you can analyze your position versus your competitor overall or by campaign, product feature, geography, or any other group you’ve previously created and make recommendations based that data. The trouble with only gathering data once in while, is that you may not actually get an acurate picture, you may be measuring a short term gain or loss for either you or your competitor.

“Competitor analysis is definitely the long game,” notes Erin. “Don’t be discouraged if you don’t make the huge gains that someone else does in the short term. Steady increase over time will typically beat short term rises which may simply indicate response to a paid ad or other traffic sources.”