Competitor Intelligence For Content Creators, SEOs, and Marketers

In the last Found Friday episode, we explored topics surrounding the common question of “are we tracking enough keywords?” A related question we often hear from clients and colleagues is “how much is enough competitor intelligence?” Plenty of research has been done on how our audiences make choices about what content they consume, and what content sticks and makes an impact. But how do we leverage that as marketers? How do we know when the research is applicable to us and our industry? This week we will explore this related question and several aspects you should consider when addressing competitor intelligence..

One major issue we see in the marketing analytics and monitoring tools market is businesses being too constrained by budget to actually track the total number of competitors that they really need. At DemandSphere, we feel differently and promote a different type of workflow for competitor content tracking. Regardless of what SEO and content marketing tools you’re using, let’s talk about what “enough” is in competitor intelligence.

Existing approaches

There are many different approaches to determine what types of competitors to track. However, in working with clients of various sizes across multiple different industries, we find a few common scenarios play out. These are the most common scenarios we have seen. Does your business fit into one?

- Scenario one, you are allowed to track three to five competitors in your platform and you’ve picked the top few most direct competitors as determined by research or marketshare.

- Scenario two, you inherited competitors in a platform when you took on your role and they have been there for a long time. You may or may not have changed one or two, but you’re still tracking mostly what has been tracked for years.

- Scenario three, you have no authority to choose or change the competitors in your analytics platform or monitoring tools and you either think there is no reason to change the status quo, or you see some opportunities for updates and want to make recommendations.

We suspect you fit into one of these scenarios. Maybe you do not. Regardless, let’s discuss some other options.

How do you know when enough is enough in competitor intelligence?

For many businesses, only tracking three to five competitors may not be covering all your bases. However, because of platform limitations, you have to make due with this hard limit. Even in a world where cost is no object, tracking 100 competitors daily to cover all your bases is probably too much. Most businesses are not going to have the bandwidth to make use of that volume of data. So, where is the sweet spot?

This is hard to say, as there’s no one right answer. Different businesses have different needs. What makes sense for one business likely won’t make sense for another. Consider a slightly different approach than honing in on a certain number. What we actually need is a more fluid way to understand the competitor landscape. The reality is, the competitor landscape is constantly changing. Competitors regularly come and go. They make moves and deliver ever changing marketing messaging that continually impacts findability.

Building on segmentation

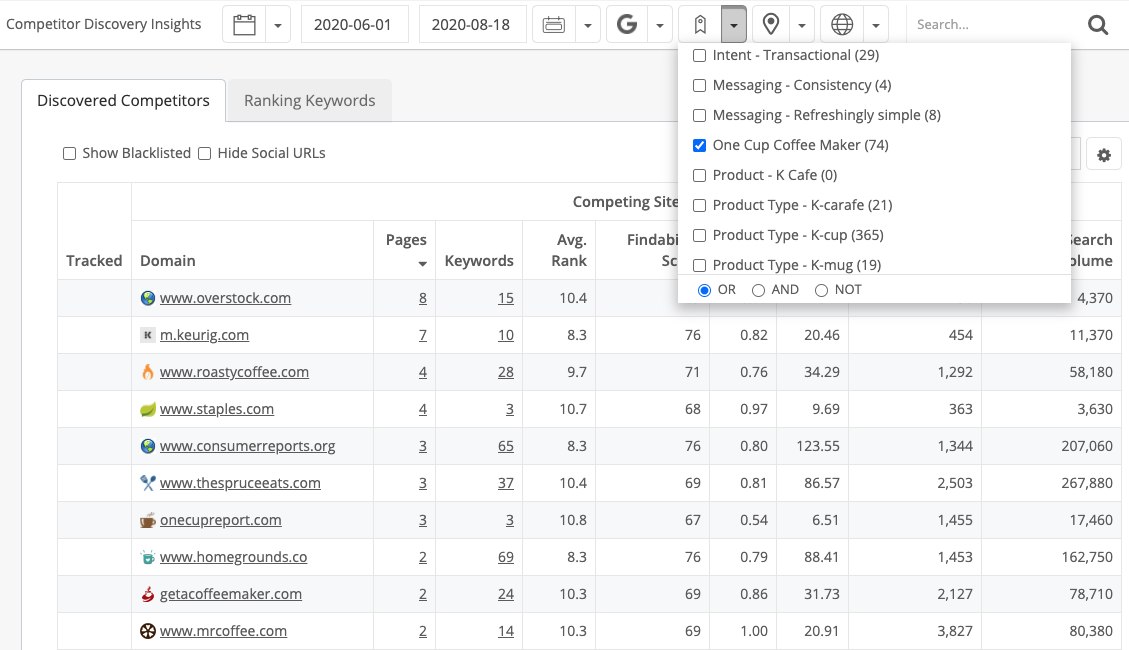

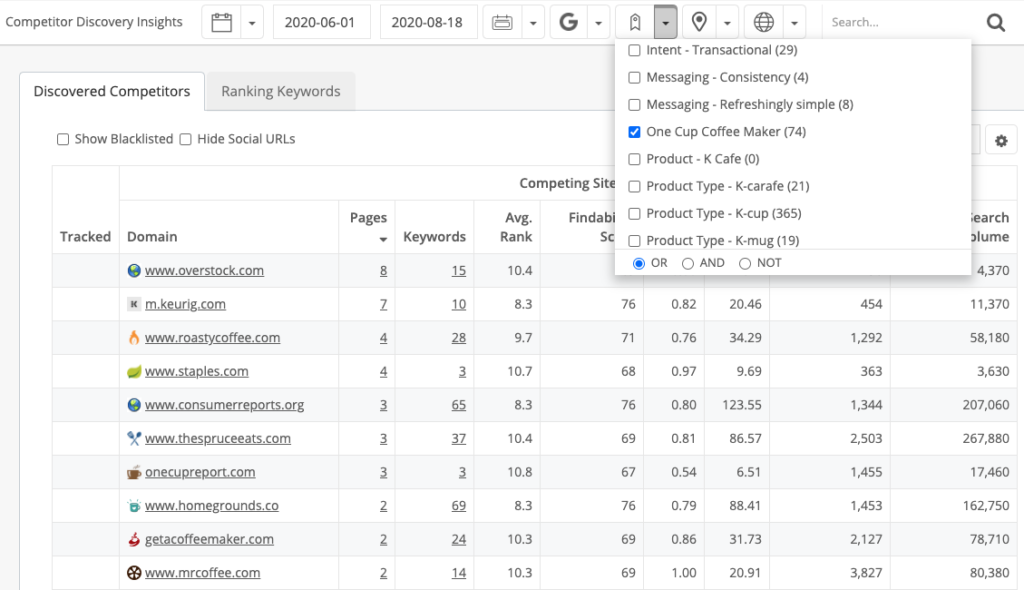

If you missed our last Found Friday episode, we discussed tracking enough keywords, the power of segmentation, and keyword grouping. Competitor intelligence joins nicely with these topics. With segmentation and grouping, the goal is to look at your marketing effort from a variety of different perspectives. Below are some examples of segment categories that we recommend and build in our clients’ dashboards:

- Product lines

- Services

- Features

- Solutions

- Campaigns

- Messages

- Audience types / personas

- Funnel stages

- Locations

Kurig as an example

Within each of these categories, there are segments that we can create detailed groups around. Let’s walk through a B2C example of a product most people know that is easy to follow. These concepts work just as well for B2B and other marketing efforts too.

Let’s say I’m Keurig, the coffee maker, coffee, and coffee making brand. Like many other organizations, Keurig has a variety of product lines that span coffee makers for individuals and businesses. They also have partnerships with coffee brands like Starbucks and Dunkin’ Donuts, in addition to their own brands. They also make accessories for their machines and have services.

Their services and offerings range from coffee auto delivery to servicing for their corporate machines. In addition to their variety of product and service offerings, they run different marketing campaigns throughout the year. Some of these campaigns are related to holidays like Mother’s Day or Christmas. Others focus on things like “summer iced coffee sale.”

The reason we’re diving into all of what Keurig does so deeply in this conversation, is that they have competitors for all of these different facets that have been highlighted. Traditional marketing competitor tracking would suggest only looking at other coffee makers like Mr. Coffee, Bunn, and Cuisinart. We’d also want to look at other coffee companies like Peet’s and Seattle’s Best.

Let’s look at Keurig’s auto-delivery option. If we dive into this specific segment, we find a whole new group of competitors whose content is ranking and taking findability away from Keurig. We immediately find Gevalia and Tassimo here. These brands were nowhere near the top of the list when looking at more traditional competitor research for coffee maker related search terms. However, once looking at a specific segment, we find highly relevant competitors that would have otherwise been overlooked.

Rethinking the approach

When we ask what is “enough” in competitor discovery, what we are really talking about are the specific competitors for each segment of your brand and marketing efforts. The number of segments will greatly impact how many competitors are “enough.” This is another example of how thorough segmentation of your site will yield benefits in many aspects of your SEO strategy.

You’ll notice that we added campaigns and messaging in the list of segmentation categories. These are the most frequently overlooked in competitor discovery and tracking. Let’s say Keurig is running a Mother’s Day campaign and they are only tracking Bunn and Mr. Coffee as competitors. They are NOT running mother’s day campaigns. However, Starbucks, Target, WalMart, and many other competitors are. How may excluding these competitors be impacting Keurig’s findability?

What impact does content have?

How do we know what content works in this specific area if we are not looking at what anyone else who is focused on mother’s day gifts in the space is doing? In addition to campaigns around holidays, there are campaigns around choosing the right coffee, different coffee maker features etc. We need to do competitor research and understanding before we launch these campaigns, during their rollout, and keep the results and competitor lists for when they’re done. We will be able to reference this data if we cycle the campaign again. Mother’s day will happen again next year, and next time we’ll be ready!

At DemandSphere, we approach competitor discovery by examining every possible competitor for content by each category and segment. Again, the amount and types of segments will vary by business and have a large impact on the “right” number of competitors. Using the above example again, this approach enables us to see who the competitors are for auto-delivery versus simple coffee brewing versus best home coffee maker.

Direct vs. indirect competitors

Direct versus indirect competitors is a concept we explored in our previous post on how many keywords is enough to track. This concept is equally important and relevant when determining how many competitors to track. Let’s quickly recall the difference between direct and indirect competition. We all know what direct competitors are – they’re the brands, products, and services that are taking away wallet share. Indirect competitors are the publications, news sources, and other places that are taking away mindshare.

In almost every case, there will be both direct and indirect competitors within each segment. Many times, because of tracking constraints in our platforms, we overlook the indirect competitors. Falling into this trap is a huge loss for marketing intelligence. Indirect competitors often populate universal search elements like knowledge panel, answer box, etc., providing very real competition for your online traffic.

Understanding what indirect competitors are doing to take mind share from our content is paramount to regaining or maintaining rank. We need to know what it is our audience was looking for that the competitor had the answer to and how they provided that answer in a way that we can be a part of, create on our own site or through offsite content.

Are you tracking enough competitors?

Every business will have a different approach to competitor intelligence. The number of competitors that is “right” needs to be determined on a case by case basis. The considerations explored above will help shed some light on if your current approach is yielding the best results. Segmenting your site is a great place to start and useful in many aspects of SEO. From here, you can narrow in on specific competitors for each segment of your business.

If you are still unsure if you are tracking enough competitors or have any other questions regarding competitor intelligence, contact us and we are happy to discuss.