What do we talk about when we talk about competitor tracking? For many of us, uncertainty makes competitor tracking an absolutely nightmare. That may be because we’re tracking incorrectly. On a recent Found Friday episode, our own Erin Acheson talked about competitor tracking — and why so many marketers struggle to make use of this important information.

Most marketers track an average of three competitors for their brand. But, does that actually work when you have multiple products, features, locations, messages, and campaigns? Different products probably face different competition. The magic “three” is an arbitrary number that limits our data set. Instead of tracking the competitors you think you have, you need to track your real competitors.

Are we identifying our real and relevant competition?

There’s no reason to only track only three competitors, or three for every product. Track as many competitors you need to get real insights into your competition! If you are using a tool that limits the number of competitors you can track, it may be worth asking whether you can add more. First, let’s talk about how we discover competitors — and why our process may not work.

For our purposes, anyone taking attention away from your content is a competitor. And, there are several common ways that organizations “discover” competitors.

Let’s look at three of those commonly-used methods — and why they may not be the best fit for your organization.

- Using competitors already identified by the organization or through the incumbent manager. Typically, your organization or client knows its competitors. However, tracking only that set of predetermined competitors can cause issues: competition does change as players leave or enter the market for certain products. It’s always worth re-examining your competition.

- Finding competitors at the full-site level. Finding competitors that compete with your full site can be really difficult. Full-site-level competitors will likely include behemoths like Amazon: a site that sells literally everything and competes with everyone. Having this information isn’t entirely useful, and may not help you see the small picture at different categories, products, and offerings. Finding competition at a smaller level helps you “slice and dice” your competitor information, and understand which competitors are siphoning revenue from specific offerings.

- Finding competitors for a few “core” keywords. Determining competitors for a few core keywords — say, your top ten best-performing keywords — severely limits the data you take to your next brainstorming session. For keywords, products, or better messaging strategy, you’ll want to consider the long tail.

So, none of the traditional means of identifying competition seems to work in our favor, but most firms keep using these same tried-and-untrue methods. The question is: why are we like this?

Why do we fail to rethink competition? Blame our brains.

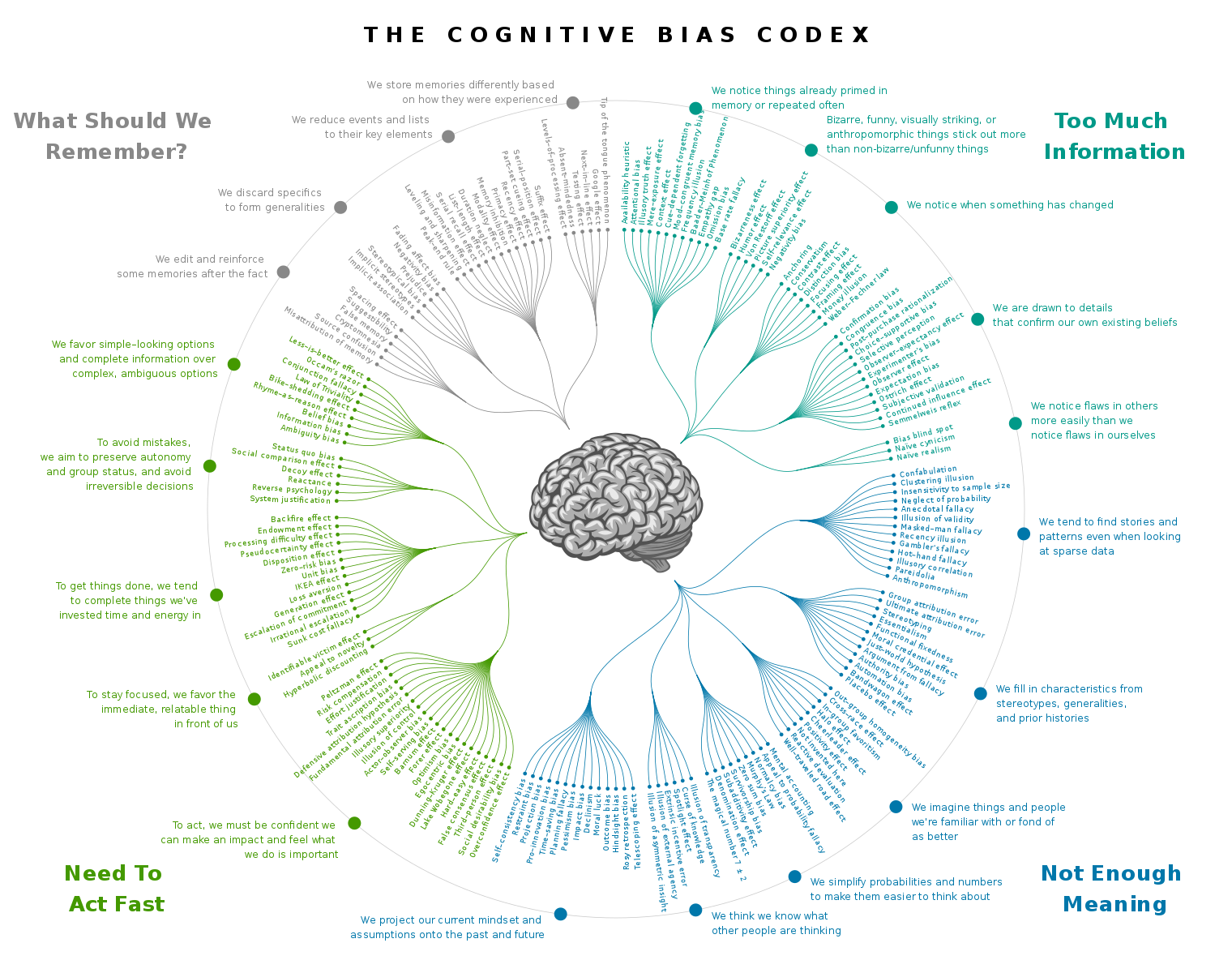

It’s easy to forget that we marketers are humans: we see patterns in data that aren’t really there. Cognitive bias is part of the reason that we tend to choose competitors incorrectly.

There are a few key reasons why we fail to find our real competition:

Too much information:

When we’re hit with information overload — and, through all of our data tracking, email campaign feedback, and big data analytics, we have plenty of information — our brains look for familiar patterns. We notice things we’ve seen before. Certain brands stick out to us as “obvious competitors,” and, when we determine which competition to track, we choose competitors that we know.

Not enough meaning:

No lie: it’s hard to derive meaning from the massive amounts of data available to us. Our minds try to force meaning into data that we don’t know how to interpret. We try to jostle competitors into segments that fit our preexisting beliefs, and may create patterns that aren’t really there. We oversimplify our conclusions to create data that’s meaningful to us.

Deadline pressure:

When we’re under the gun — say, on a deadline for a report or rushing to build out a new campaign — we favor relatable data that’s right in front of us, even if it’s incomplete or inaccurate. We go with “known answers” to avoid mistakes. Because we’re looking for the safest possible answers as we determine which competitors to track, we lean toward competitors that have been accepted in the past.

We just can’t handle all the data:

Again, as marketers — especially content marketers — get hit with a ton of data. We tend to reduce our massive list of potential competitors down to a few key players, even if useful information exists further down the list. So, we stick with a top two to three competitors, disregarding options that may teach us more about our content. We disregard the specifics and form generalizations, grouping some competitors together. You may think, “these two competitors are similar, so we don’t need to analyze both.” But, their content and messaging strategies may be completely different — and, we may lose out on important info when we generalize.

Seriously: it’s so much data.

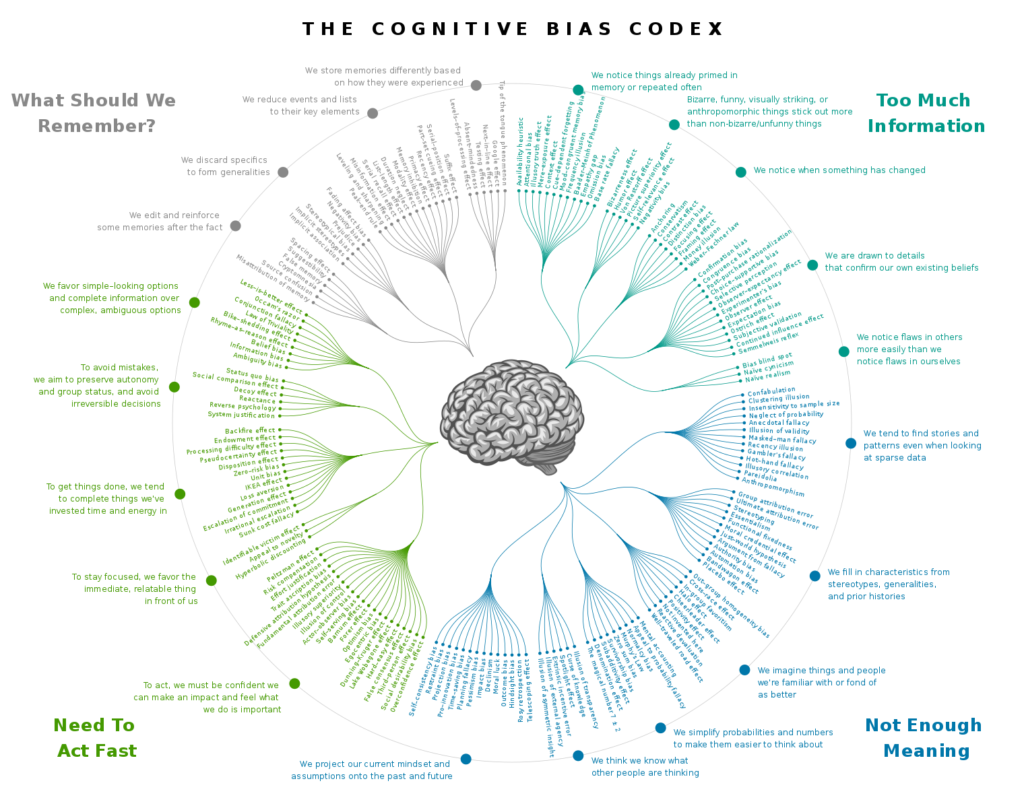

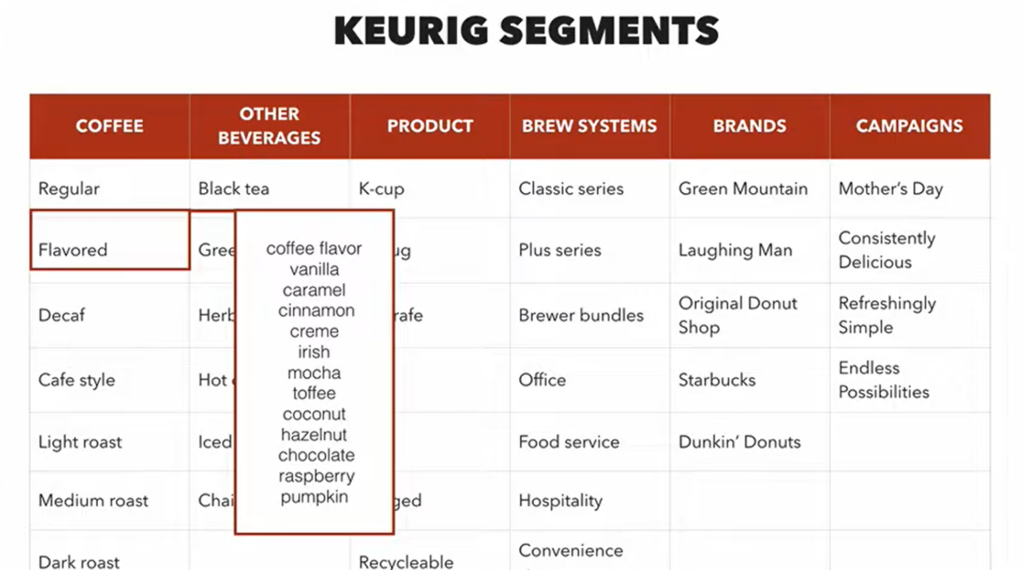

Erin uses an example to illustrate just how much data shows up during an average competitor search. She plugs “keurig.com” — not one of our customers, just an example! — into Google Keyword Planner, and receives around 700 suggested keywords. There are around 1,100 suggested keywords related to “coffee maker” and “coffee brewing.”

Searching for “best coffee maker” on Google ads to the noise. Google’s SERP includes shopping and ads results, knowledge panel results, and related questions — the regular search results are below the fold. Because all of these extended elements exist, there are more than 20 products listed on the first page alone — and Keurig is only represented in the paid ads.

Using our own DemandSphere competition tracking software, Erin enters the 700 branded keywords that Google Keyword Planner returned for keurig.com. She receives 388 competitors to choose from. That’s 388 competitors that provide some value to our competition knowledge: but, we’re not sure how to use that information. What products are we competing over? What segments do we share?

How can you break down competitor tracking data?

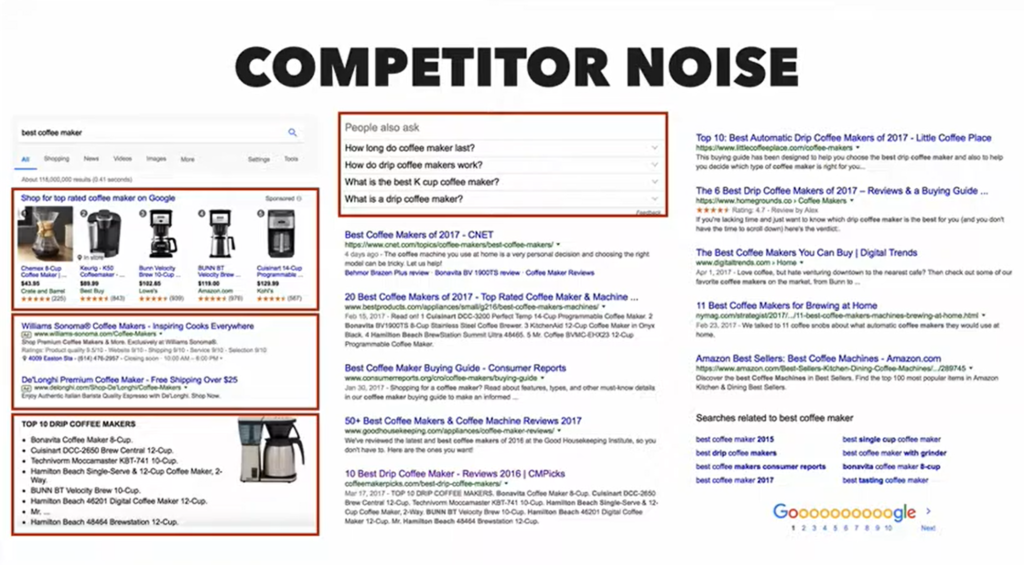

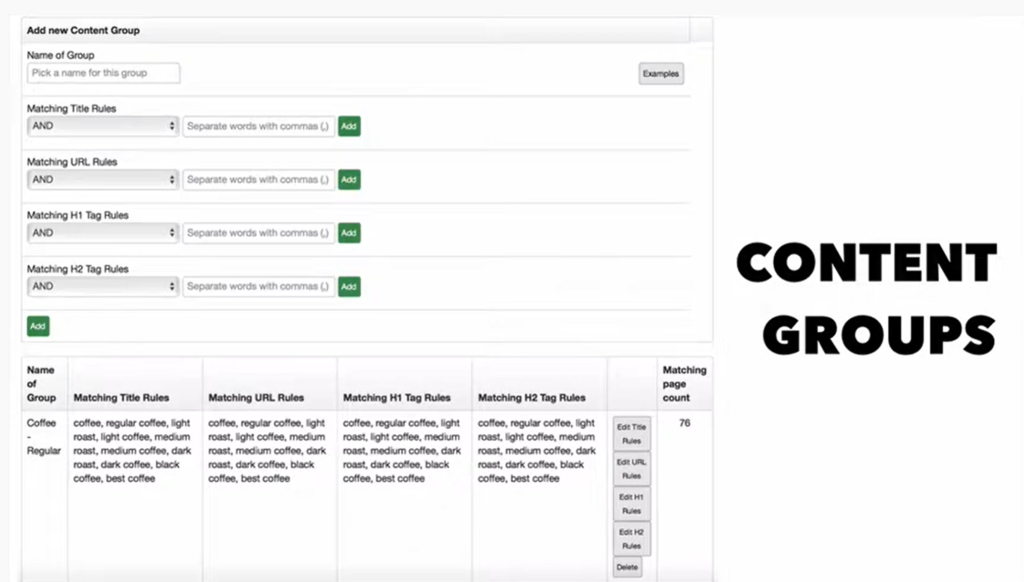

Erin creates a sample grouping of how she might classify the terms revealed through Keyword Planner. In the coffee example, she groups “types of coffee,” “brew systems,” “brands,” and other segments. Then, inside the DemandSphere platform, she tracks keywords associated with each group. When she creates the keyword groups inside the platform, those grouped terms allow for quick analytics tied to each campaign or messaging strategy. Keyword grouping allows you to find related keywords as the platform recognizes terms searched by the same users entering your grouped keywords. Erin uses the DemandSphere platform to group content by page titles, URLs, H1 and H2 tags related to certain keywords.

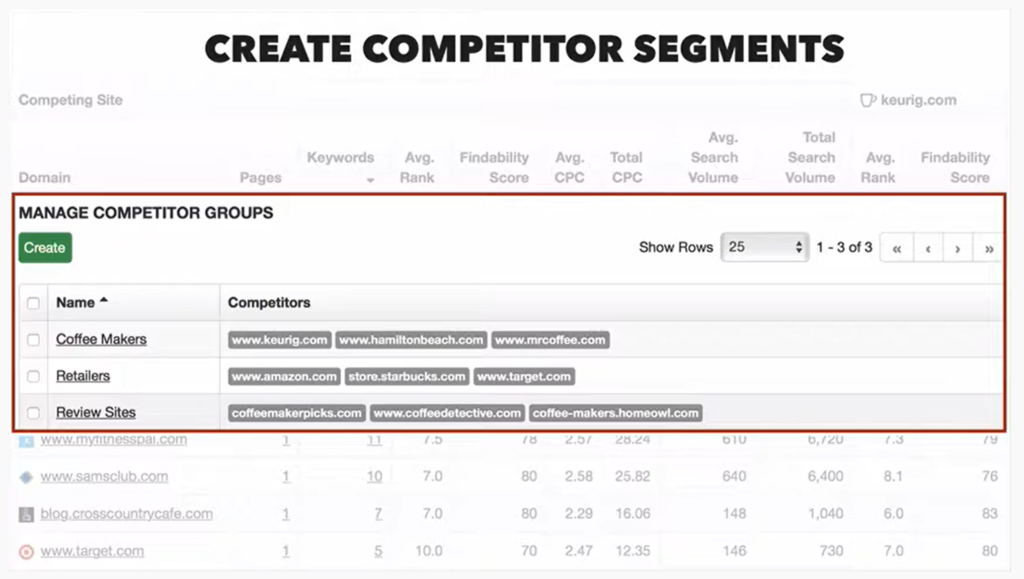

After that, we’re onto more grouping: Erin creates competitor review groups like “review sites” and “coffee maker brands.” She also recommends creating competitor groups by messaging types. Where are you losing video views to other sites with awesome video? Are you losing eyeballs on a specific set of keywords or concepts?

Remember, competition doesn’t consist of only other brands. Shopping sites, review sites, and anything else that pulls eyeballs from your site. Competitors can belong to multiple areas and messaging types.

Your segmentation will pay off.

Once you create these groups, you’re armed and ready for action. By creating lists of competitors by campaign, product, feature or industry segment, you can:

- Discover and segment relevant competitors.

- View all ranking content related to a particular segment.

- Sell all the keywords you’re battling for.

- Check out competitor ranks, associated content and more.

We’ll be talking more about competitor tracking in our next post on the topic. In the meantime, keep an eye out for your own biases in competitor tracking — and think about ways that more robust tracking could help.

In the market for an SEO platform that can help you find your real and relevant competition? Schedule a discovery call with DemandSphere to find out how we can help.