Publish better content. Drive traffic. Create conversions. Build brand awareness. Reach KPIs. Raise ROI. Beat the competition. Lots of marching orders and goals for marketers and the brands they represent. Everyone is already looking at what the competition is doing, including things they’re doing better. But how do you know what is working for competitors, who the right competition is, and how the rest of the industry stacks up?

Compare Rankings

To get started, compare where you’re showing up in page rankings compared with your competitors when you search for keywords associated with your brand and your marketing focus. Look to see how well-respected pieces of content are being promoted across social networks. Start to get a feel for the industry as a whole. Not everyone is measuring the same thing or approaching the problem in the same way. Learn where your competitors have put their efforts. Use a platform to help gain these insights and organize them by campaigns.

Take a safari into your competitive landscape with a focus on discovering:

- Who is in the jungle

- Who they are hunting

- What tools they are using

- What message they are sending

- How they are sending the message – what channels they are using

- How others are faring on the ranking food chain

Your safari should help you to better understand how all marketing campaigns and channels are contributing to the overall findability of the content brands are creating. At a minimum, be aware of industry surroundings but beware of being overly obsessed with your competitors and losing sight of your own company goals.

Track These Stats

Knowing your competitors is not a one time foray into the wilds of the internet. Really understanding trends requires daily monitoring and looking at trends over time. Watch how targeted topic’s rankings change over time and compare with competitor rankings on the same topics. If there is movement by a competitor, it is useful to see what they are doing. If they’re focusing on one topic and increasing their content and focus on that topic, it may indicate a shift or new product announcement pending. Keep your keyword list manageable and refresh it as time goes by.

Prioritize your keywords depending on how competitors are performing for your keywords. Look for keywords your competitors are measuring that you are not. Be sure you are keeping an eye on the larger trends across the ecosystem.

Keep in mind that competitors change focus and those who were once competition may not stay in the same market, and likewise companies that weren’t previously considered competition may become a formidable opponent over time.

Here are some other stats to keep your eye on:

- Identify the parts of the search to determine commercial intent (ex: “best” indicates the search is research oriented)

- Keyword groups – long phrases help to keep tabs on your content performance and competitor performance

- Social signals by phrase/keyword help to determine patterns of what people are talking about

Social Insights

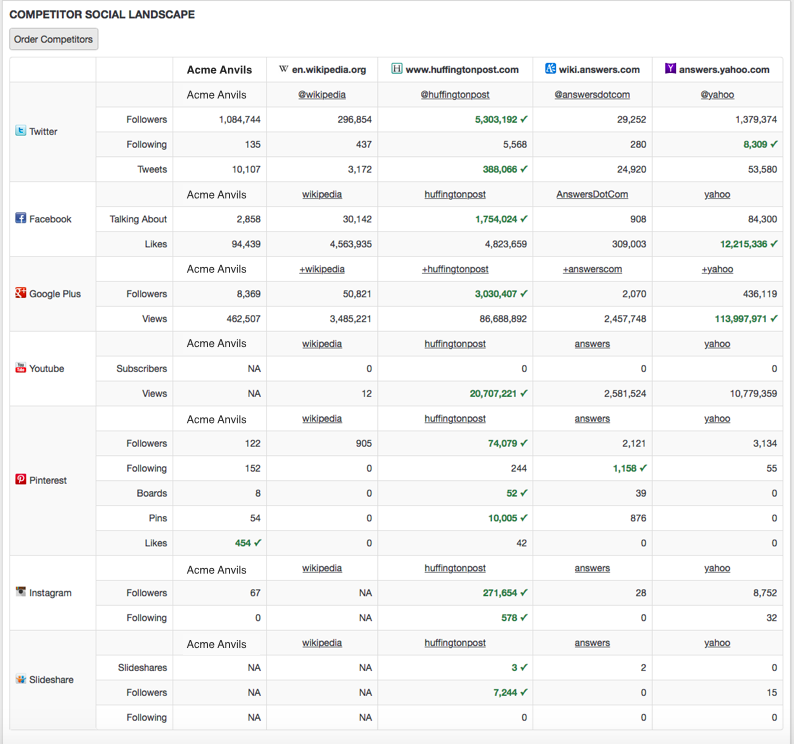

While in discovery mode, you’ll want to get a feeling for your competitor’s presence from the social aspect. Doing your own investigations into the competitor’s social ecosystem may not be as intuitive as looking for their ranking or comparing search signals. However, there is still a lot of competitor information to be gleaned by watching them in their native habitats of Twitter, Facebook, and others. This area of discovery and measurement has grown considerably just recently with tools available to measure social engagement across channels and in comparison to the competition. If your brand has not yet adopted the more advanced tools for this process, you can still get a feel for the competition and get a sense of some indicators such as:

- Audience Size

- Overall imprint on the market

- Branding

While you’ll gain valuable insights, looking at social signals alone does not determine the rate of conversion, purchasing habits, or new customer acquisitions. There is still no one-to-one correlation between social virality, such as page likes, and increased findability. Social is still part of the larger ecosystem and not only can it be used to gauge brand awareness, you can use it to inform and improve future content decisions.

Imitate to Improve

“Imitation is not just the sincerest form of flattery – it’s the sincerest form of learning.” – George Bernard Shaw

Why start from scratch when your competitors may already have written a recipe that has either succeeded or failed? Learn from their failures and successes and improve on both. Learn what your audience is responding to and give them what they want. Best practices are rarely created on the first try. Trends and standard practices come from a lot of trial and innovation, creating a series of building blocks that become best practices.

Look at your competitors as fellow innovators in the space. Think of it as a way to collaborate with other really smart people in your industry. Even if you are in competition, you can learn a lot from others who are trying to solve the same problem you are. Being involved in the industry can help to drive the industry forward and shows you what you need to focus on to be perceived as a leader. If you aren’t paying attention, you run the risk of being blindsided. As you know your competitors, so will you know their audience. Mine Twitter, Facebook, and Google+ social sites for potential contacts. Turn the questions that are being asked into actions you can take to grow your business. Become part of the ecosystem and a native to the influencers and decision makers.

The Industry Next Door

As long as you are on an adventure of discovery, look next door and monitor those adjacent industries. These may be companies that will partner well with your company down the road. Ideally, these would be companies that only do 10% of what you do and the rest of their wheelhouse is different. Look carefully at their product offerings and compare against your own. You may discover that there is something you need to be incorporating into your product. You may need aspects of that tool to stay relevant. Pay particular attention to small start-ups in your industry. These brands will be more nimble and flexible and may determine their roadmap based on market demands. In the end, you do care about what is working for competitors and the industry. What is working for them, should be working for you, as well.