Recently, we talked about identifying our real and relevant competition — and why that process is so difficult. Once you accept that your site has dozens — or hundreds — of other sites playing for the same keywords, tracking those competitors can feel daunting. On a recent Found Friday, Erin Acheson spoke on finding those competitors, and, even better, using that discovery to inform your content strategy. Let’s call this Competitor Discovery: Part II.

To recap: You need to discover your real competition.

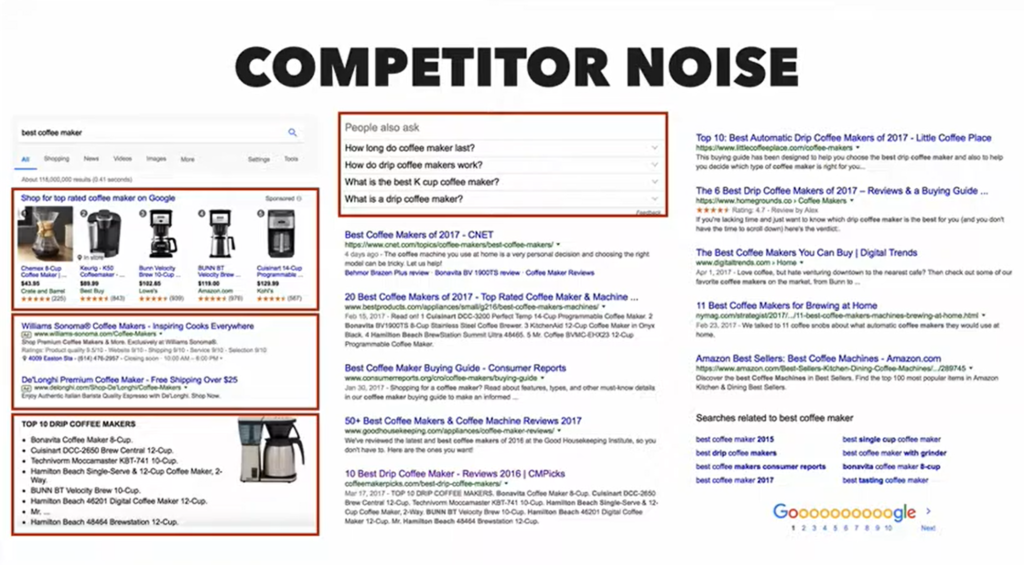

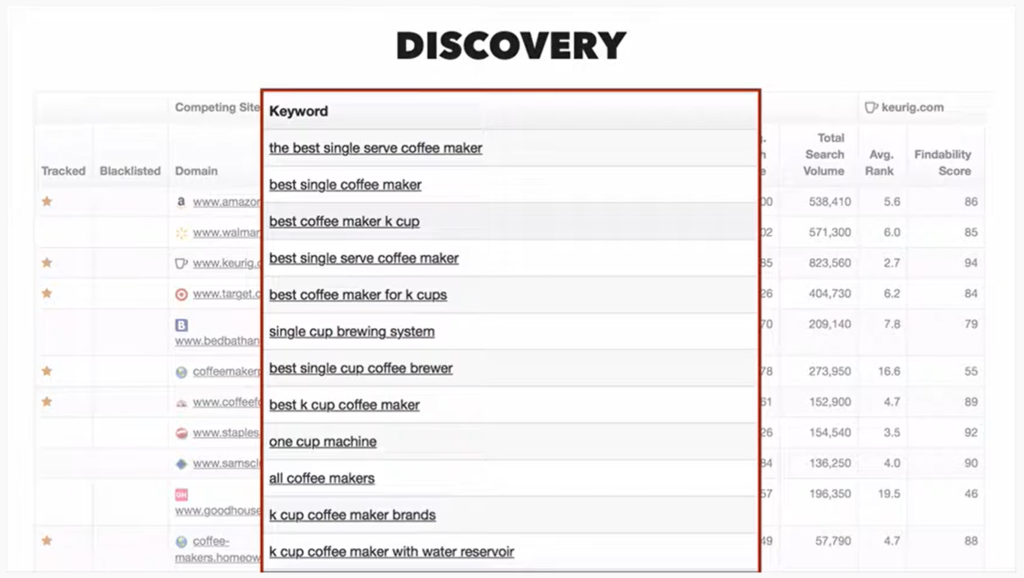

In the last post, Erin plugged a branded term, “keurig.com” into Google Keyword Planner, and received around 700 suggested keywords. A related term, “best coffee maker,” brought up around 1,100 keywords. Google also provides plenty of SERP static for those popular terms: everything from blue links to shopping and ads results to related questions. Here’s how Erin turned those keywords into data-backed competitor info.

-

Erin entered the 700 branded keywords into DemandSphere’s competitor discovery tool. The tool gave her 388 competitors — and that information, by itself, can be hard to work through.

Let’s look at this list. Each of Erin’s coffee competitors comes with its own list of content and associated keywords. Not only does that list give her a ton of information to sift through, it’s hard to derive real meaning from such a massive amount of data. There’s no real meaning attached! At this stage, the platform might assume that the top competitors — i.e., the ones with the most terms overlapping Keurig’s — are massive sites like Amazon, Walmart and Target. But, these behemoths compete with everyone, and looking at their pages may not provide good insights into Erin’s coffee campaign.

-

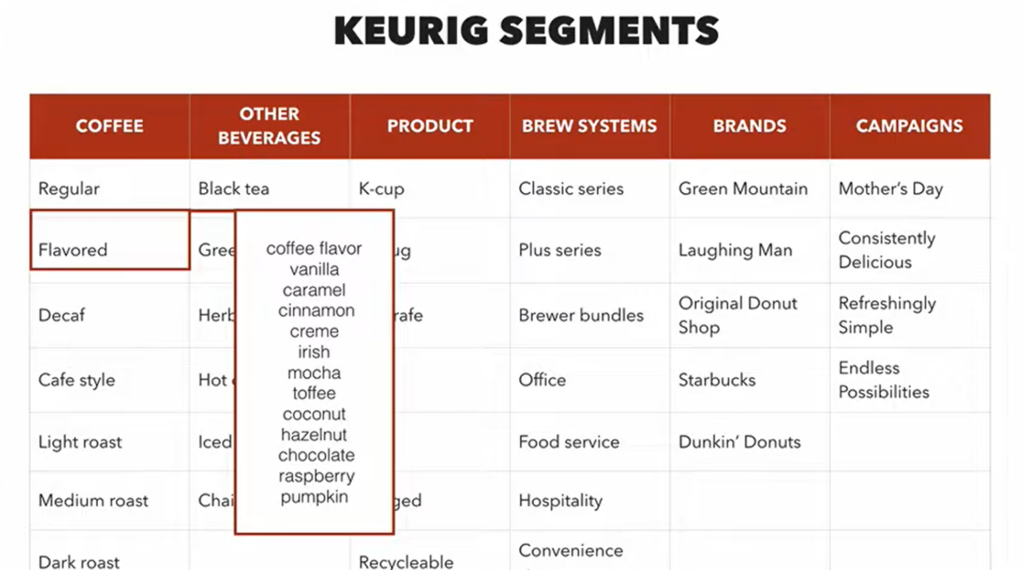

Next, she created a sample grouping of how she might classify the keywords she’s discovered.

For example, she created groups like “brew systems,” and “types of coffee.” Then, inside the DemandSphere platform, she grouped and subgrouped those keywords. For example, “flavored coffee” fell under “types of coffee,” and included terms like “vanilla coffee.”

-

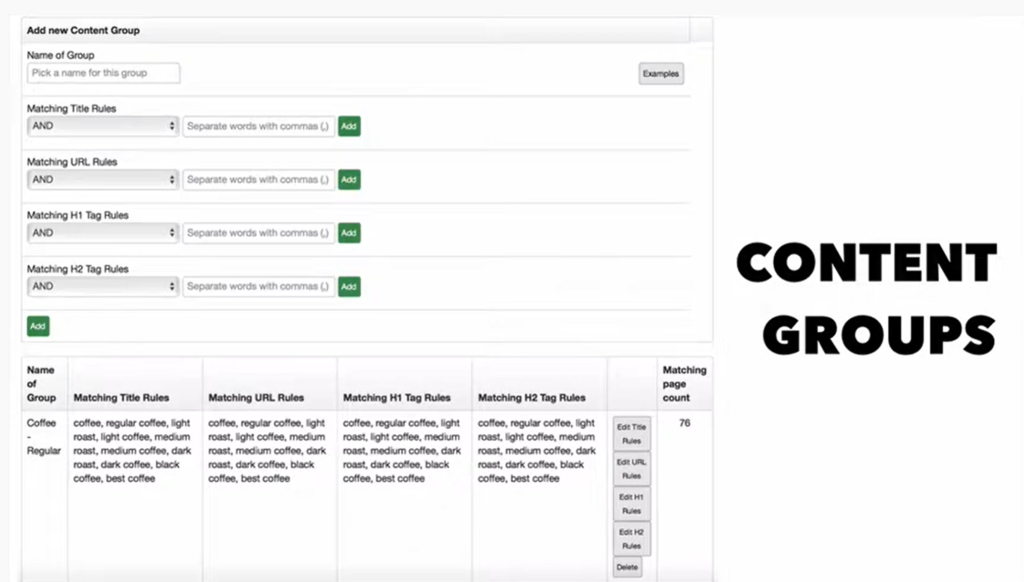

Next, Erin created content group using title, URL, and <h> tag matching.

DemandSphere allows you to use “and/or” language, so you can search for “pumpkin spice” but not “lattes.” It also allows for manually-added content.

Erin breaks those keywords into content groups. -

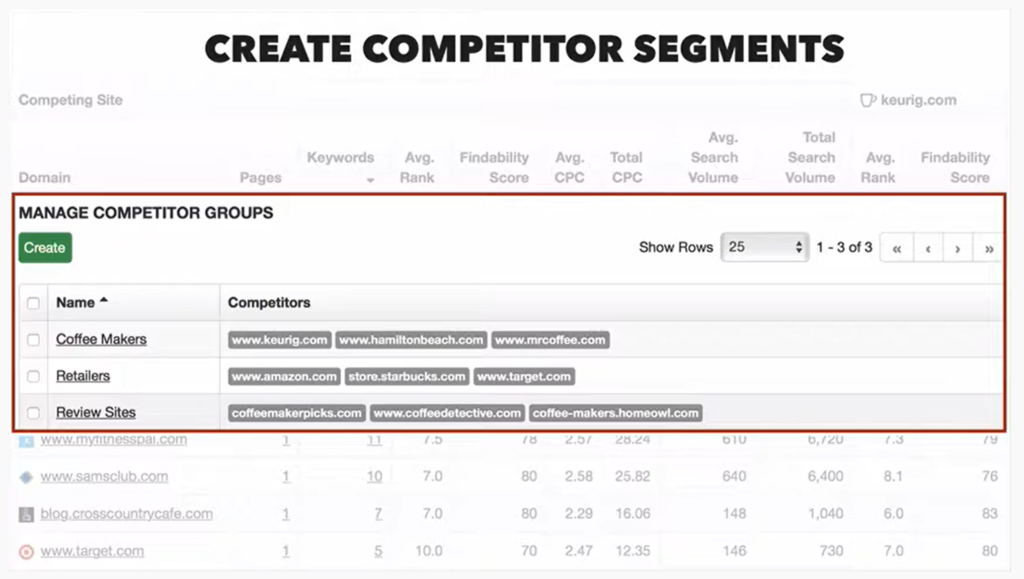

After creating content groups, Erin segmented the competitors she’d previously discovered.

Next, Erin placed the competitors into groups using matching rules. Which competitors are competing on certain products, like “flavored coffee pods?” Competitor groups may be tied tied by similar things: maybe all of your retailers are in one group, and your review sites comprise another. Since competitors can belong to multiple groups, it’s useful to group things by different strategies. Maybe one competitor creates a lot of blog content, or one targets specific locations.

-

After performing this content segmentation and competitor grouping, Erin is armed with lots of lists: of competitors, keywords, and content types.

These will allow her to:

- Discover and segment relevant competitors.

- View all ranking content related to a particular segment.

- See all the keywords you’re battling for, competitor ranks, associated content and more.

Let’s go back and look at the original groups of keywords Erin created. She looks for competitors for single-serve coffee makers. What content have those competitors created that overlaps for that segment? From there, we can discover keywords that associate with that type of content. By drilling down into the specific keywords, we can get better topic ideas, plan for possible product expansion, and more.

Bringing real analysis to your data

Many of us struggle with taking all of that data into actionable information. Here are just a few areas where you can benefit from drilled-down, segmented competitor discovery.

Find out who is competing in just one area, or for a specific group of features.

You may be overlooking competitors that have a content stronghold in one particular segment. In the Keurig example, Erin tried looking for competitors for automatic coffee pod delivery. It turns out that coffee subscriptions aren’t only a success for Amazon and coffee clubs! Erin found that Tassimo and Gevalia’s sites performed well for “coffee auto delivery” and related terms. Discovering new competitors can help you review their top-performing content and top-performing keywords — and identify any content gaps you can fill.

This competitor info is also helpful when you’re launching a new campaign. Say you want to launch a campaign for a new or highlight a product — in the Keurig example, maybe that’s dark-roasted coffee pods. You’re getting a way to look and see content what competitors have created around a certain topic — before launching that new campaign.

Figure out if certain types of content outperform in certain segments.

Do videos outperform blog posts for one segment, but not another? Do certain messages resonate better for a specific type of content? Are certain competitors creating that type of content really well? Erin found that searches for superlative terms like “best coffee maker” returned lots of review sites — CNET, BestProducts.com, and CoffeeMakerPicks.com. Those sites tended to feature slideshows and short video clips of the products being reviewed. In short, multimedia and photo content performs better for the “best coffee maker” search term. If you want to sell a coffee maker on that term, that may be the kind of content you want to serve up.

Use your competitive analysis to refresh your messaging.

Maybe there are certain keywords or concepts present in your messaging. Keurig’s site features a campaign with the term “refreshingly simple” repeated throughout. If someone is searching for a simple brewing system, what are they likely to find? What “refreshing” imagery do your competitors use, and how can you stand out?

Check out changes in competition based on location or seasonality.

Some competitors vary based on location or timeline. What messaging strategies work well in some regions but not others, or in urban but not rural areas? How can you tailor your successful holiday campaign to work in the summer? Don’t track the same competitors around the country, and don’t track the same competitors throughout the entire year.

Examine changes to top-performing content type based on search volume.

What tends to be the type of content type based on search volumes? Do certain types of content perform well based on popular search topics, while some types perform well in the long tail? Does that information change on a cyclical basis?

Keep in mind that competitor analysis isn’t a one-and-done game. The DemandSphere system automatically populates competitor groups with relevant keywords and content. By building out competitor segments, you can stay on top of changing competition throughout the year. If you’d like to find out more about our competitor tracking software — or need help navigating this complex field — schedule a discovery call to find out more.