How you set up your content initially and in your analytics system determines how well you’ll be able to measure it. In addition to tracking your own content, rankings, and findability, you’re most likely trying to keep an eye on the market and other competitors in your space. Tracking their content and findability metrics alongside your own comes with challenges.

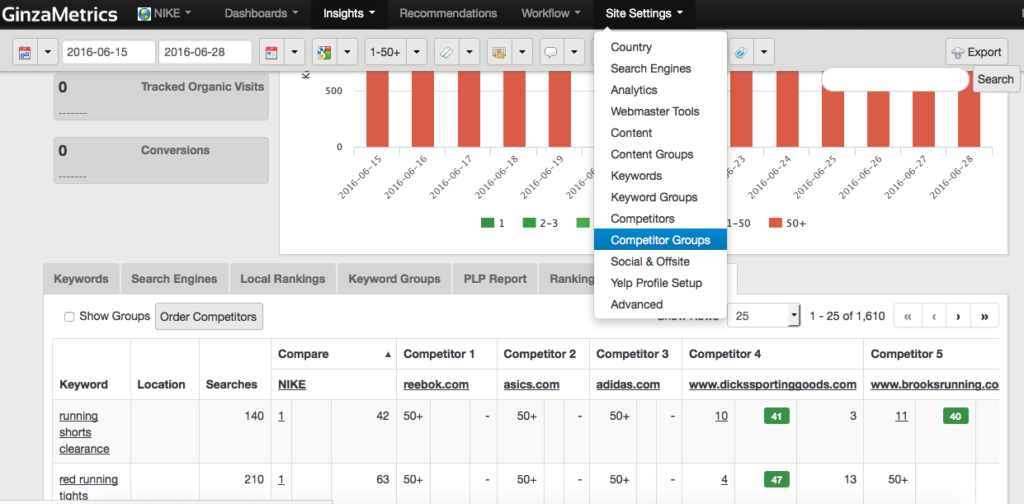

Depending on the size of your site, competitors may not be relevant for every product, feature, or location – meaning you’ve got different competitors that align more closely with different groups of content. We talk a lot on the show about keyword and content groups, but this last week we focused on competitor groups and why they’re important.

How do competitor groups work?

Competitor groups are a way to understand how specific competitors or particular competitor content is coinciding with your content across a variety of areas, including:

- Products

- Features

- Geographies / locations

- Campaigns

- Audience personas

- Content type (blog, white paper, case study, ebook, advertorial, video, etc.)

One way to simplify this process is to create keyword and content groups that match marketing needs (likely the items listed above or something similar) and then to use Competitor Discovery to figure out who is creating competing content. These may be existing competitors that you’re already tracking or you may find new competitors that are specific to these areas.

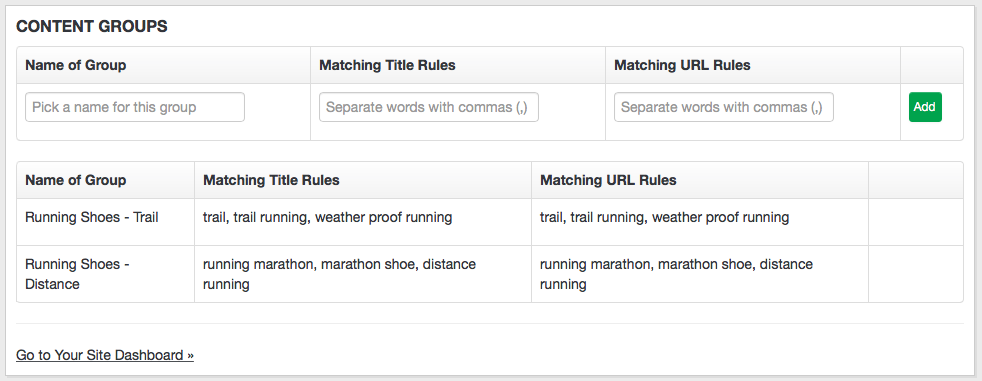

So lets back up to content and keyword groups. When you create keyword and content groups you can segment out various areas of your marketing efforts to compare and contrast how audiences are interacting with your brand.

I’ll use Nike as an example to explain how this works. Nike makes a lot of different athletic products. Obviously the type of person who is buying basketball products may not be the same as someone buying running shoes. But, even within the category of running shoes, there are many different types of audiences. Including:

- Avid marathoners

- Trail runners

- Gym members

- Joggers

- Walkers

And various ages including:

- Children

- Young adults

- Adults

- Seniors

For each of these potential content groups (content can belong to more than one group), you can have keywords that are associated with driving traffic to that content. The keywords for adult trail runners versus senior joggers are likely very different, even if they’re all ending up at running shoe products. Creating content groups helps you figure out how people are talking about their needs specifically so you can target your marketing and content efforts more accurately.

Now, we can move on to competitor groups. When we’re talking about who the competition is for your audiences, we’re not just talking about the people who are directly selling competing product and services. We’re also talking about anyone who’s taking traffic away from what you’re specifically creating to get attention. In the case of Nike, competitors may include reviews of running shoes, articles about how to buy running shoes, or any other content that uses the keywords and phrases Nike is trying to rank for.

If you’re able to discover your content competitors, you can create competitor groups to reflect direct competitors versus indirect competitors. This may mean grouping your competitors by things like “Brands” versus “Publications” or by various locations. Using competitor groups you can segment your competitors in a variety of ways and then add them to multiple groups for analysis.

Why are competitor groups important?

If you match your competitor groups to your keyword and content groups, you can understand which competitors are taking traffic away from you and which content they’re using to get audience share. Before you spend a lot of time creating more marketing content, you can make better decisions based on specifically how competitors are taking traffic from your content and what they’re creating that’s getting more audience attention.

Although it can seem a daunting task to set up content, keyword, and competitor groups, it doesn’t have to take a lot of time and resources, if you’re using a tool like GinzaMetrics. Using the setup wizard, you can input matching rules using specific keywords and phrases. Then, we gather all the content and keywords that fit and add them to the group for you. Of course, you have the ability to edit and can add or delete keywords and content from groups without disturbing your ability to get individual metrics on that particular asset.

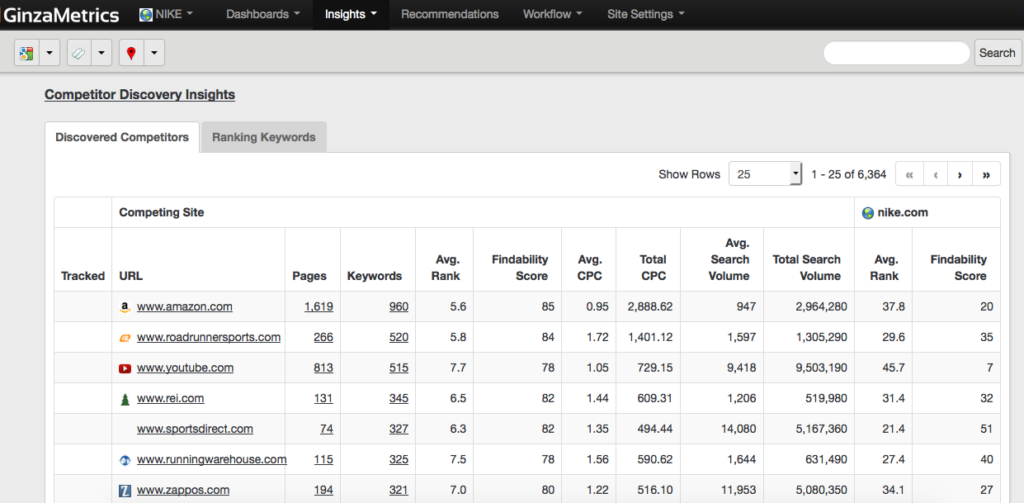

Competitor groups work the same way. Once you’re tracking a competitor, you can just check them off and add them into the groups. This feature works really well with our Competitor Discovery feature. Competitor Discovery isn’t just looking at the brands that you’re already aware of, it also identifies any piece of content that’s taking traffic away from you and where that content originated.

Let’s go back to the Nike example of running shoes. Let’s say you have a group within the running shoes category called “trail running shoes” and you only need to identify and track competitors for this one category. Competitor Discovery will identify anyone who is ranking for your keywords in the running shoe campaign. It will also show you:

- Search volume

- Projected monthly traffic

- CPC data

- Findability score

- Average rank

- Specific content

- Associated keywords

Newly discovered competitors can become their own competitor group or you can segment them further by direct and indirect competitors or any other identifier, based on your needs.

Getting started with competitor groups

When you’re ready to get started grouping content, keywords, and competitors, start by creating a framework of groups that would make sense based on how you’re already doing business. If you haven’t created content or keyword groups, start with one or two high-level groups and add more granular groupings as you go along.

Don’t feel like you need to figure out the entire structure all at one time. You may find that once you create an initial structure, it will need to be edited to get the data you’re looking for anyway. So, I recommend starting out with a couple of groups and see where those take you. Based on the data you get, decide on next steps. You can also always contact us and we’re happy to walk through it with you and to help you get set up.

I think it’s best to mirror keyword groups, content groups, and competitor groups so you can compare cohort groups to see how specific keywords are performing or what keywords are driving traffic to specific content. Content, keyword, and competitor groups can help you answer these strategic questions:

- How does content in one campaign compare to content in another campaign?

- What are ranking differences between groups?

- What does engagement look like within and between groups?

- Who are competitors associated with specific content?

- What changes or additions need to be made to groups of content?

If you’re only watching the competitors you already know about, you aren’t getting the whole picture. Discovering everyone and every piece of content that is in direct competition and then grouping competitors in concert with content and keywords will help you to understand what’s working and what’s not at a deeper, more meaningful level.

If you’re like most marketers, the sheer volume of content on your website is making measurement and decision make more difficult and there’s no let-up in site. Creating content, keyword, and competitor groups is a way to take control of your content marketing results and make decisions based on real outcomes. If you don’t have a tool that will help you get the marketing intelligence you need, give us a shout and we’ll show you around GinzaMetrics.